The Hidden Cost of

DIY Bookkeeping

You Can't Afford.

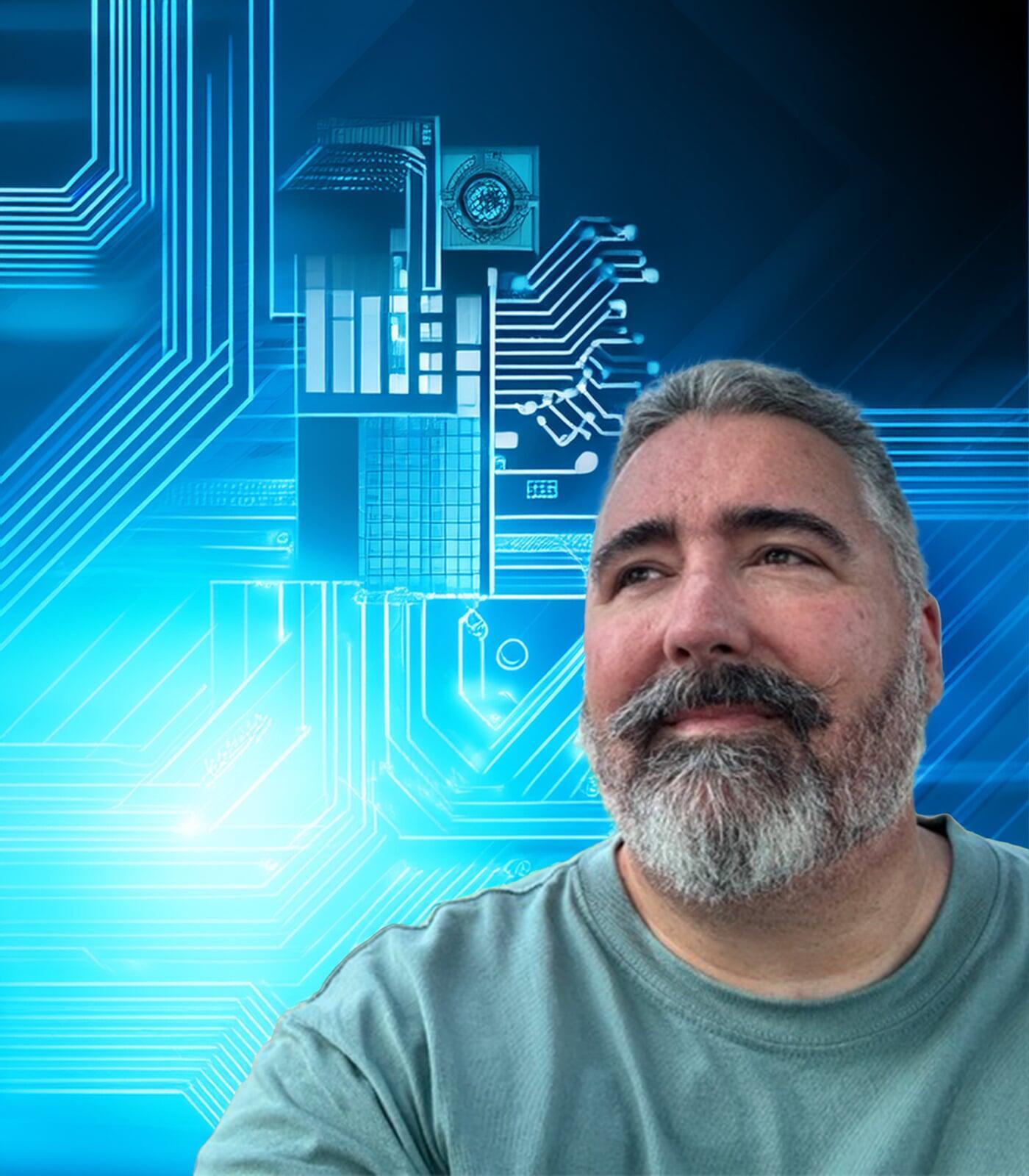

By Richard Majkrzak

For a business owner, managing bookkeeping can feel like a necessary evil, pulling time away from core business operations and strategic growth planning. This burden often leads to stress throughout the year and last-minute panic during tax season.

Lack of regular transaction categorization and monthly financial reconciliation hinders the ability to produce accurate reports and statements throughout the year, leading to ongoing uncertainty about the business's financial health.

Now imagine having your financial transactions accurately categorized and reviewed weekly, accounts reconciled monthly, and financial reports delivered regularly—all seamlessly behind the scenes.

Your time is your most valuable asset. Delegating your bookkeeping to a professional isn't an expense—it's an investment in your company's strategic potential. By removing the administrative burden of financial management, you'll create the bandwidth to innovate, make critical decisions, and accelerate your business growth. And, maintain your sanity!

1. Strategic Time Reallocation

2. Expertise Optimization

2. Expertise Optimization

3. Stress Reduction and Mental Bandwidth

Constant bookkeeping stress creates mental fatigue that diminishes your capacity for creative problem-solving and strategic thinking. When you're bogged down with financial record-keeping, you're mentally unavailable for the high-level thinking required to drive business growth. Delegating this function frees up significant mental and emotional energy, allowing you to redirect it towards innovative solutions and critical business decisions.

So, understanding the benefits of delegating your bookkeeping is one thing, but actually making it happen and realizing the real benefits is another—especially if you’re not already using accounting software. But don't worry, I'm here to help.

I'm Richard, a former corporate IT leader who now owns a small business myself.

I'm Richard, a former corporate IT leader who now owns a small business myself.

I intimately understand how administrative accounting tasks can distract from what matters most—growing your business. That's why I've shifted my career journey into a mission of alleviating this burden from other small business owners. My background in both business and technology means I don't just manage your books—I optimize the entire process.

As an Intuit Certified QuickBooks ProAdvisor, my approach combines the precision of accurate bookkeeping with the power of modern technology. I bring a level of technical expertise that goes beyond traditional bookkeeping, wherever you are in the United States.

Want to know more about how we can

transform your bookkeeping operations?

Accurate Financial Tracking

Accurate Financial Tracking

Up-To-Date Balances

Up-To-Date Balances

Clear Financial Insights

Clear Financial Insights

How It Works

Step 1: Book your FREE consultation

Let's discuss your business operations, bookkeeping challenges, and future goals. I'll outline my services and explain how I can support you in achieving those goals.

Step 2: I’ll prepare a quote

If we both feel my services are a good fit for your business, I’ll conduct a quick analysis to verify the scope and complexity of your books in order to provide you an accurate quote.

Step 3: Sign up and rest easy

Once you accept the quote, we’ll sign you up and schedule a start date for me to begin working on your books.

Here's What You'll Get...

Here's What You'll Get...

QuickBooks Online and Chart of Accounts setup, organization, and maintenance.

Weekly categorization of all transactions based on the Chart of Accounts.

Monthly reconciliation of Checking Accounts, Savings Accounts, and Credit Cards.